If you would like to save the current entries to the secure online database, tap or click on the Data tab, select “New Data Record”, give the data record a name, then tap or click the Save button. Based on your entries, this is the future value of the annuity you entered information for. You might also be interested in learning how to calculate the present value of an annuity.

Benefits of Annuities

- Note that the present annuity calculator can deal exclusively with fixed immediate annuities.

- The Set for Life instant scratch n’ win ticket offers players a chance to win [latex]\$1,000[/latex] per week for the next [latex]25[/latex] years starting immediately upon validation.

- This field should already be filled in if you are using a newer web browser with javascript turned on.

- The future value of an annuity is calculated against the number of time intervals.

- Our mission is to provide useful online tools to evaluate investment and compare different saving strategies.

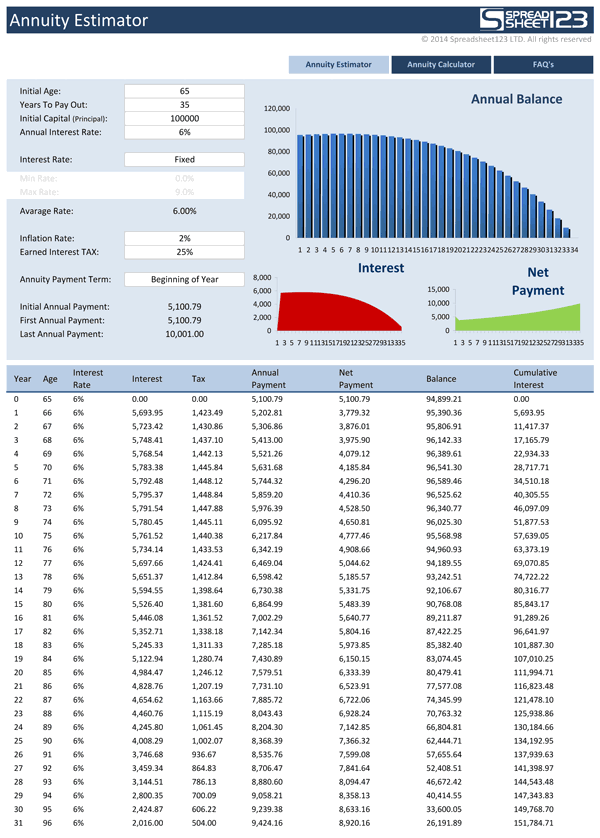

A fixed annuity is an insurance product that accumulates interest at a fixed rate on a lump sum premium before converting the principal and interest into a guaranteed income stream. The calculator can also help you compare the terms of different fixed annuities to find which one would be most beneficial to you. If you’re considering a few different products, try plugging in the interest rates and other details of each one to see which annuity will grow your premium investment by the greatest amount. The purpose of the fixed annuity calculator is to help you estimate how much your fixed annuity contract will grow over time.

How To Use the Fixed Annuity Calculator

Enter the corresponding payment/deposit amount for the selected interval (without dollar sign or comma). Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice.

From Wakeboarding to Real Estate: How One Man Turned His Athletic Career Into an Investment Strategy

“When you make the payments at the end of each time interval then we call it the ordinary annuity”. Suppose you are considering entering into a data plan for your smart phone that will cost you $35 per month. In order to make an informed decision, you need to be aware of and give equal weight to the financial opportunity costs that will come with a monthly expenditure of $35.00 for a non-essential expendable. From my perspective, the periodic amounts represent payments, as in, I must remove the amounts from an interest earning account in order to pay them to you. Continuously compounding interest will cause annuities to generate slightly more value—although this also creates some calculation challenges. When interest growth is continuous, the payment schedule relies on a logarithmic scale.

An online annuity calculator makes calculating the growth of an insurance annuity easy. With just a few data points, you can decide if an annuity will provide the investment return that meets your financial needs. Annuities are special investments issued by insurance companies that are designed to provide a stable, consistent payment to the investor. In most cases, the insurance company guarantees a certain payment regardless of the condition of the market. This is useful for retired people since the payments will continue for the policyholder’s life.

Variable Annuity Calculator

Now that you are (hopefully) familiar with the financial jargon applied in this calculator, we will provide an overview of the equations involved in the computation. When Roberto’s son turns [latex]18[/latex], the trust fund will have a balance of [latex]\$63,672.39[/latex]. Again, please note that the one cent difference in these results, $5,801.92 vs. $5,801.91, is due to rounding in the first calculation. Note that the one cent difference in these results, $5,525.64 vs. $5,525.63, is due to rounding in the first calculation. If you’re interested in buying an annuity, a representative will provide you with a free, no-obligation quote. Annuity.org partners with outside experts to ensure we are providing accurate financial content.

Since this kind of annuity is only paid under particular circumstances, it is called a contingent annuity (i.e., it is contingent on how long the annuitant lives for). If the contract specifies the period in advance, we call it a certain or guaranteed annuity. To calculate the future value of annuity due, make sure the calculator is in BGN mode.

The surrender charge is usually imposed during the first several years of an annuity contract, and the percentage that is charged declines each year. A variable annuity might charge a 9% penalty on funds withdrawn in the first year, an 8% penalty in the second year, a 7% penalty in the third year and so on. Insurance companies apply a surrender charge to a variable annuity contract if the annuity owner withdraws money early. To account for payments occurring at the beginning of each period, the ordinary annuity FV formula above requires a slight modification. The pros of fixed annuities are that the income is predictable and the risk of losing money is extremely low. The cons of fixed annuities are that their growth potential is lower than other types of annuities and may not keep pace with inflation.

The present value of an annuity is how much that annuity is worth right now, assuming a specific rate of return (also known as the “discount rate”). The future value of an annuity, which also assumes a specific discount rate, represents how much that annuity will be worth in the future. Identifying the present and future values of an annuity can help you determine whether or not an annuity investment is a good choice for you. With a fixed annuity, there is no need to speculate where the markets might be moving—the $3,000 payment remains the same, no matter what. Choosing between an immediate or deferred annuity is just as important as choosing between a fixed or variable annuity. However, there is a third category that is becoming increasingly common, called “indexed annuities,” which combines aspects of both.

You can also add $100 per month from your regular salary and $1,000 per year from your work bonus. They are concerned that the value of their investments could decrease during their retirement, causing them to run out of money. They decide to invest a portion of their money in an insurance annuity to lock in guaranteed income to protect automate 1099 form their portfolio. They invest $500,000 in an annuity that guarantees payment of approximately $2,100 per month. Calculating an annuity’s future value will help you determine if investing in one makes sense for you. While annuities can be a great retirement-planning vehicle, we recommend exploring all your available investment options.