Indeed, starters would likely be better served if they are cognizant of the risks identified by frontrunners and followers alike (figure 11) and begin anticipating them at the onset, giving them more time to plan how to mitigate them. Without the right gen AI operating model in place, it is tough to incorporate enough structure and move quickly enough to generate enterprise-wide impact. To choose the operating model that works best, financial institutions need to address some important points, such as setting expectations for the gen AI team’s role and embedding flexibility into the model so it can adapt over time.

Embed AI in strategic plans with emphasis on organizationwide implementation

For slower-moving organizations, such rapid change could stress their operating models. Fintechs remain at the forefront of harnessing gen AI and many of their use cases and solutions are impacting financial services. For example, Synthesia utilizes an AI platform to create high-quality video and voiceover content tailored for financial services, while Deriskly provides AI software aimed at optimizing compliance in financial promotions and communications.

Methodology: Identifying AI frontrunners among financial institutions

The most well-thought-out application can stall if it isn’t carefully designed to encourage employees and customers to use it. Employees will not fully leverage a tool if they’re not comfortable with the technology and don’t understand its limitations. Similarly, transformative technology can create turf wars among even the best-intentioned executives. At one institution, a cutting-edge AI tool did not achieve its full online bookkeeping service for small businesses potential with the sales force because executives couldn’t decide whether it was a “product” or a “capability” and, therefore, did not put their shoulders behind the rollout.

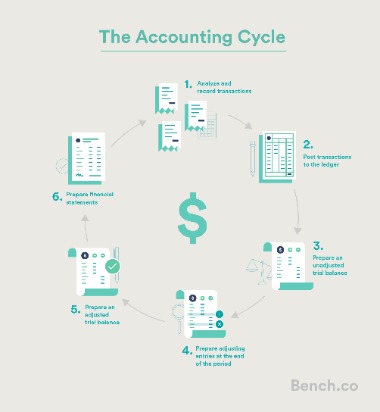

This portfolio approach likely enabled frontrunners to accelerate the development of AI solutions through options such as AI-as-a-service and automated machine learning. At the same time, through crowdsourced development communities, they were able to tap into a wider pool of talent from around the world. While many financial services companies agree that AI could be critical for building a successful competitive advantage, the difference in the number of respondents in the three clusters in a bank reconciliation what happens to the outstanding checks that acknowledged the critical strategic importance of AI is quite telling (figure 3). An operating model is a representation of how a company runs, including its structure (roles and responsibilities, governance, and decision making), processes (performance management, systems, and technology), and people (skills, culture, and informal networks).

- We recently conducted a review of gen AI use by 16 of the largest financial institutions across Europe and the United States, collectively representing nearly $26 trillion in assets.

- Doug Dannemiller is the investment management research leader at the Deloitte Center for Financial Services.

- With gen AI shifting so fast from novelty to mainstream preoccupation, it’s critical to avoid the missteps that can slow you down or potentially derail your efforts altogether.

- But scaling gen AI will demand more than learning new terminology—management teams will need to decipher and consider the several potential pathways gen AI could create, and to adapt strategically and position themselves for optionality.

- As the technology matures, the pendulum will likely swing toward a more federated approach, but so far, centralization has brought the best results.

Gen AI certainly has the potential to create significant value for banks and other financial institutions by improving their productivity. But scaling up is always hard, and it’s still unclear how effectively banks will bring gen AI solutions to market and persuade employees and customers to fully embrace them. Only by following a plan that engages all of the relevant hurdles, complications, and opportunities will banks tap the enormous promise of gen AI long into the future. To effectively capitalize on the advantages offered by AI, companies may need to fundamentally reconsider how humans and machines interact within their organizations as well as externally with their value chain partners and customers. Rather than taking a siloed approach and having to reinvent the wheel with each new initiative, financial services executives should consider deploying AI tools systematically across their organizations, encompassing every business process and function. We have found that across industries, a high degree of centralization works best for gen AI operating models.

Too often, banking leaders call for new operating models to support new technologies. Successful institutions’ models already enable flexibility and scalability to support new capabilities. An operating model that is fit for scale-up is cross-functional and aligns accountabilities and responsibilities between delivery and business teams. Cross-functional teams bring coherence and transparency to implementation, by putting product teams closer to businesses and ensuring that use cases meet specific business outcomes. Processes such as funding, staffing, procurement, and risk management get rewired to facilitate speed, scale, and flexibility. Just as the smartphone catalyzed an entire ecosystem of businesses and business models, gen AI is making relevant the full range of advanced analytics capabilities and applications.

Citizens Bank for example, expects to see up to 20% efficiency gains through gen AI as it automates activities like coding, customer service and fraud detection. In the future, these co-pilots could tailor investment strategies in real-time or predict market trends, helping to fortify FS firms’ competitive edge and deliver differentiated client outcomes. Rob is a principal with Deloitte Consulting LLP leading the Operating Model Transformation market offering for Operations Transformation.

Biggest Challenges in Achieving AI Goals

While a higher number of implementations undertaken could partly explain this divergence, the learning curve of frontrunners could give them a more pragmatic understanding of the skills required for implementing AI projects. Frontrunners have taken an early lead in realizing better business outcomes (figure 8), especially in achieving revenue enhancement goals, including creating new products and pursuing new markets. Value delivery could either include customizing offerings to specific client preferences, or continuously engaging through multiple channels via intelligent solutions such as chatbots, virtual clones, and digital voice assistants. We found that companies could be divided into three clusters based on the number of full AI implementations and the financial return achieved from them (figure 1). Each of these clusters represents respondents at different phases of their current AI journey.

The operating model with the best results

Learn wny reduce credit card processing expenses with non embracing AI and digital innovation at scale has become imperative for banks to stay competitive. Guardrails to ensure ethics, regulatory compliance, transparency and explainability—so that stakeholders understand the decisions made by the financial institution—are essential in order to balance the benefits of AI with responsible and accountable use. By establishing oversight and clear rules regarding its application, AI can continue to evolve as a trusted, powerful tool in the financial industry.

It is also no surprise, given the recognition of strategic importance, that frontrunners are investing in AI more heavily than other segments, while also accelerating their spending at a higher rate. Close to half of the frontrunners surveyed had invested more than US$5 million in AI projects compared to 27 percent of followers and only 15 percent of starters (figure 5). In fact, 70 percent of frontrunners plan to increase their AI investments by 10 percent or more in the next fiscal year, compared to 46 percent of followers and 38 percent of starters (figure 6). Financial services are entering the artificial intelligence arena and are at varying stages of incorporating it into their long-term organizational strategies.