As we said earlier, variable costs have a direct relationship with production levels. As production levels increase, so do variable costs and vise versa. Fixed costs stay the same no matter what the level of production.

Formula and Calculation of Contribution Margin

Calculations with given assumptions follow in the Examples of Contribution Margin section. Doing this break-even analysis helps FP&A (financial planning & analysis) teams determine the appropriate sale price for a product, the profitability of a product, and the budget allocation for each project. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference. A university van will hold eight passengers, at a cost of \(\$200\) per van.

Get in Touch With a Financial Advisor

The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. The contribution margin ratio is used by finance professionals to analyze a company’s profitability.

How do you maximize your contribution margin?

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period. This is if you need to evaluate your company’s future performance.

How is contribution margin calculated?

- On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company.

- The more customers she serves, the more food and beverages she must buy.

- And the quickest way to make the needed changes is to use a scheduling and labor management tool like Sling.

- See in real-time what each shift will cost your business and adjust the expenses accordingly.

Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs. Profit is gross margin minus the remaining expenses, aka net income. With a contribution margin of $200,000, the company is making enough money to cover its fixed costs of $160,000, with $40,000 left over in profit.

In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)). If they sold \(250\) shirts, again assuming an individual variable cost per shirt of \(\$10\), then the total variable costs would \(\$2,500 (250 × \$10)\). In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000. Remember, the per-unit variable cost of producing a single unit of your product in a particular production schedule remains constant. The Indirect Costs are the costs that cannot be directly linked to the production.

After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

So, it is an important financial ratio to examine the effectiveness of your business operations. Sales revenue refers to the total income your what are management skills and why are they important business generates as a result of selling goods or services. Furthermore, sales revenue can be categorized into gross and net sales revenue.

Contribution margin ratio is the difference between your business’s sales (or revenue) and variable expenses for a given time period. As the name suggests, contribution margin ratio is expressed as a percentage. It means there’s more money for covering fixed costs and contributing to profit. A business has a negative contribution margin when variable expenses are more than net sales revenue. If the contribution margin for a product is negative, management should make a decision to discontinue a product or keep selling the product for strategic reasons. Cost accountants, financial analysts, and the company’s management team should use the contribution margin formula.

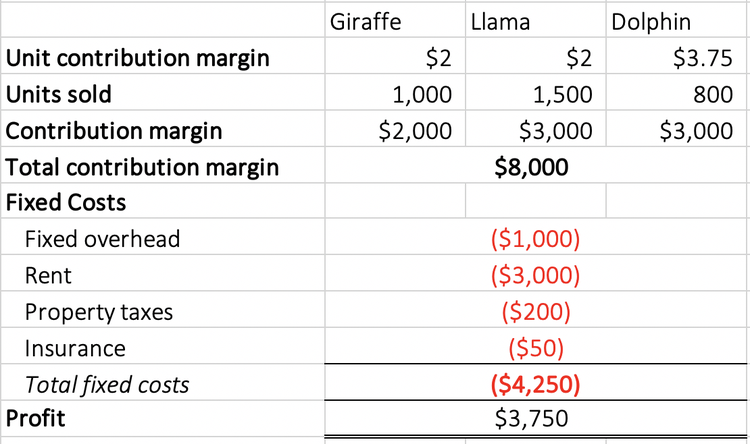

Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued. When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. In general, the higher the contribution margin ratio, the better. But what is considered “good” largely can depend on your industry.

To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail. However, this implies that a company has zero variable costs, which is not realistic for most industries. As such, companies should aim to have the highest contribution margin ratio possible, as this gives them a higher likelihood of covering its fixed costs with the money remaining to reach profitability. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.